Europe’s share of global minerals production has plunged from 25% to less than 7% in 40 years, intensifying the need for a domestic supply boost to meet climate goals. With EU Raw Materials Week 2024 in full swing, a new report, A Critical Raw Material Supply-Side Innovation Roadmap for the EU Energy Transition, has cast a spotlight on Europe’s mounting reliance on imported minerals essential for clean energy technologies.

A Strategic Turning Point

The report, a collaboration between the Energy Transitions Commission (ETC), systems change firm Systemiq, and Bill Gates-founded Breakthrough Energy, underscores a critical juncture for the EU.

Lord Adair Turner, Chair of the ETC, stated: “In the long-term, the shift to a clean energy system will lead to a circular system with limited need for further resource extraction. However, in the immediate future, we must intensify our efforts to secure critical raw materials essential for the energy transition. Simultaneously, we must strive to mitigate the environmental and social impacts of extraction, striking a delicate balance between progress and preservation.”

The urgency stems from surging demand for six essential raw materials—copper, nickel, cobalt, lithium, graphite, and rare earth elements—that power technologies from electric vehicles to wind turbines. Without swift action, the EU risks missing its net-zero targets due to supply shortfalls.

The EU’s Policy Response: CRMA’s Ambitious Goals

The EU Critical Raw Materials Act (CRMA), enforced earlier this year, sets bold targets: by 2030, at least 10% of the EU’s annual mineral consumption should come from domestic mining, 40% from refining, and 25% from recycling. Additionally, the act caps reliance on any one external country at 65%.

However, progress has been slow. Local opposition and lengthy permitting processes have stymied several key projects.

Today, copper remains the only mineral on track to meet CRMA’s 2030 targets, while lithium and graphite face the steepest hurdles.

Eveline Speelman, a Partner at Systemiq said: “The EU faces a critical juncture in securing sustainable supplies of raw materials essential for its clean energy transition. Our analysis details technologies that could be pivotal in achieving the EU’s triple objective of fostering innovation, ensuring competitiveness in a low-carbon future, and reducing dependencies. With the right approach, Europe can meet its critical raw material needs and set a new global standard for responsible resource management, strengthening its position in the global innovation race.”

Lithium mining, such as at this mine in Iquique, Chile, is highly water-intensive and is often situated in drought-prone regions.

A Dirty Business

Energy-intensive processes like copper smelting and synthetic graphite production rely heavily on coal-powered electricity, making them carbon-intensive. Reducing emissions will require electrifying operations and using renewable energy in refining processes.

Water use is another major challenge. Lithium and copper mining are highly water-intensive, often occurring in drought-prone regions like Chile and Inner Mongolia. Improved water recycling and closed-loop extraction could reduce environmental stress. Chemical pollution is also a concern, especially with nickel and cobalt mining, which uses harmful reagents that can acidify local ecosystems.

Mining also generates vast amounts of waste. Tailings from copper mining pose long-term contamination risks if not managed securely. In addition, land use impacts include deforestation and habitat loss due to open-pit mining. Social concerns, including unsafe working conditions and child labor in cobalt extraction, further complicate the sector.

Technologies that Could Reshape Europe’s Resource Future

The report highlights seven emerging technologies that could revolutionize raw material production while reducing environmental impacts such as greenhouse gas (GHG) emissions, water use, and waste generation.

Key innovations that could transform the supply chain are:

- Geothermal Direct Lithium Extraction (DLE):

This cutting-edge method taps into geothermal brine to extract lithium with minimal environmental impact. It avoids the water-intensive evaporation ponds used in conventional lithium extraction and produces near-zero emissions. If commercialized, two proposed projects alone could meet 7% of the EU’s projected lithium demand by 2035.

One notable project is Vulcan Energy Resources’ Zero Carbon Lithium Project in the Upper Rhine Valley, Germany. Vulcan aims to produce lithium hydroxide with a net-zero carbon footprint by utilizing geothermal energy to power its extraction process.

Another significant initiative is the AGeLi (Alsace Géothermie Lithium) project in Alsace, France, a collaboration between Eramet and Electricité de Strasbourg. This project focuses on extracting lithium from geothermal waters in the Alsace subsoil, aiming to develop one of the world’s most responsible lithium production methods.

- Novel Synthetic Graphite Production:

Currently, synthetic graphite manufacturing is highly carbon-intensive, relying on petroleum coke and energy-heavy processes. The proposed new method, powered by renewable electricity, could slash emissions by over 90%. This approach could meet up to 40% of the EU’s graphite needs by 2035, reducing reliance on Chinese imports.

- Primary Sulfide Leaching for Copper:

A revolutionary bio-leaching process could extract copper from low-grade ores that are currently discarded as waste. By deploying this method, the EU could supply 12% of global copper demand by 2035, with significantly lower emissions compared to conventional smelting.

- Application of AI in Geological Data Analysis:

Artificial intelligence (AI) is poised to enhance the efficiency of mineral exploration by analyzing complex geological data. This could reduce exploration drilling costs by 25% and increase discovery success rates from 5% to 75%.

- Advanced Rock Comminution:

Traditional mining processes involve crushing and grinding rocks, consuming vast amounts of energy. A new pulse power technology could cut total mining energy use by 30%, improving efficiency while reducing operational costs.

- Electrochemical Metal Extraction:

This process could redefine how metals like copper and lithium are extracted through electrochemical reactions, bypassing energy-heavy smelting entirely. The result: lower emissions, less chemical waste, and reduced water usage.

- Tailings Reprocessing:

The EU generates millions of tonnes of mining waste each year, much of which contains valuable minerals. Advanced tailings reprocessing could transform this liability into an asset, reducing environmental hazards while boosting material supply.

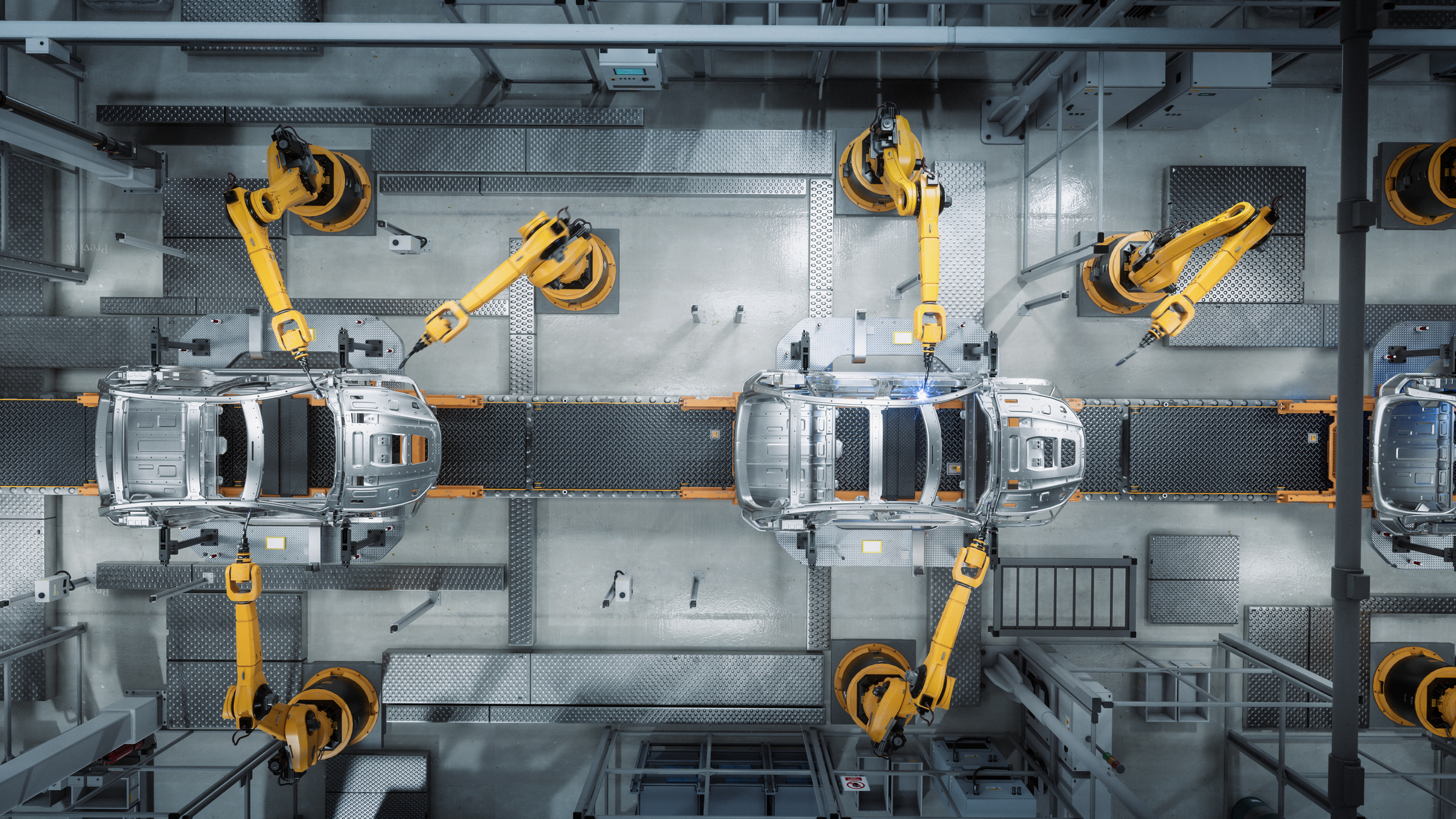

EV manufacturers are a major user of minerals. Reducing the environmental impact of mining would benefit the sector hugely.

Greening the Clean Energy Supply Chain

These technological breakthroughs could reshape the environmental impact of mineral extraction. Scaling low-carbon lithium and synthetic graphite production could cut emissions from electric vehicle (EV) batteries by up to 90% while raising costs by just 1%. This would enable greener EV production without pricing out consumers.

Additionally, innovative refining techniques could reduce the emissions footprint of materials such as nickel and cobalt, which currently have some of the highest environmental costs due to carbon-intensive mining and processing.

Closing the Innovation Funding Gap

Despite promising technologies, Europe faces a stark funding gap compared to the US and China.

As Julia Reinaud, Senior Director at Breakthrough Energy, stressed: “Accelerating investment for R&D and deployment and creating a supportive regulatory and trade environment that establishes robust domestic supply chains for critical raw materials is a necessity for the EU to secure a leadership role in the clean energy sector. By leveraging innovative technologies, the EU can reclaim competitiveness, bolster its strategic autonomy, and minimise the environmental footprint of mining and refining processes.”

The report recommends combining capital and operational expenditure (CAPEX and OPEX) support mechanisms to ensure large-scale deployments. This approach, coupled with streamlined permitting, could jumpstart innovation-driven projects.

The Road Ahead

The European Union’s Competitiveness Compass, recently announced by President Ursula von Der Leyen, aims to close the EU’s innovation gap with the US and China. This can’t be done without critical raw materials. Will the EU rise to the challenge?

With the stakes so high, the EU’s path forward now hinges on decisive action. A mix of policy support, technological innovation, and collaborative investment could, theoretically, secure Europe’s position as a clean energy leader while reducing its mineral import dependency.

Q&A: Critical Raw Materials in the EU

1. What are Critical Raw Materials (CRMs) and why are they important for the EU?

Critical Raw Materials (CRMs) are raw materials that are essential for key EU industries, including renewable energy, electric vehicles, and digital technologies, but face supply risks. They are vital for the EU’s green and digital transitions, its strategic autonomy, and global competitiveness. The EU is currently highly reliant on imports for most CRMs, especially for new battery materials.

2. What is the EU doing to address the CRM supply challenge?

The EU has introduced the Critical Raw Materials Act (CRMA) to ensure a secure and sustainable supply of CRMs. It aims to diversify sourcing, promote domestic production, recycling, and innovation in the CRM value chain. The CRMA sets targets for the EU’s domestic share of mining, processing, and recycling of CRMs by 2030, set at 10%, 40%, and 25% of annual consumption, respectively.

3. What are the main environmental challenges associated with CRM mining?

CRM mining can have significant environmental impacts, including high energy consumption, greenhouse gas emissions, water usage, acidification, tailings production, and potential threats to biodiversity. These impacts are particularly concerning for certain CRMs like nickel and cobalt.

4. What are some innovative solutions to reduce the environmental footprint of CRM mining?

Several innovative technologies aim to reduce the environmental footprint of CRM mining, such as:

- Direct Lithium Extraction (DLE): Extracts lithium from brine more efficiently and with less environmental impact than traditional evaporation ponds.

- Primary Sulfide Leaching: Enables the extraction of copper from sulfide ores, which are more abundant than oxide ores, with reduced energy consumption and emissions.

- Novel Rock Comminution: Uses technologies like pulse power to break rock more efficiently, reducing energy consumption and emissions in the crushing and grinding process.

- Tailings Reprocessing: Recovers valuable minerals from mining waste, reducing environmental hazards and providing additional material supply.

5. How can the EU stimulate innovation in the CRM sector?

The EU can stimulate innovation through various mechanisms, including:

- Funding research and development: Programs like Horizon Europe support research and innovation in CRM extraction and processing.

- Providing financial incentives: Tax credits and loan guarantees can encourage investment in new technologies and domestic production.

- Facilitating offtake agreements: Mechanisms to connect CRM suppliers with buyers can help mitigate price volatility and de-risk investments.

- Streamlining permitting processes: Designating Strategic Projects for expedited permitting can accelerate the development of new mines and processing facilities.

6. What are the main barriers to scaling up innovative CRM technologies in the EU?

Scaling up innovative CRM technologies faces several challenges, including:

- High upfront costs: New technologies often require significant investment, which can be a barrier to adoption.

- Technological risks: Unproven technologies may face operational challenges and require further development before reaching commercial scale.

- Social acceptance: Mining projects often face local opposition due to environmental and social concerns.

- Permitting delays: Lengthy permitting processes can hinder the development of new mines and processing facilities.

7. How can the EU ensure social acceptance for CRM mining projects?

Building social acceptance requires:

- Transparent and inclusive engagement: Early and continuous engagement with local communities, addressing their concerns, and ensuring benefits are shared.

- Environmental and social responsibility: Implementing best practices to minimize environmental impacts and ensure the well-being of communities.

- Sustainable development approach: Integrating economic, environmental, and social considerations into project planning and implementation.

8. What is the outlook for CRM supply and demand in the EU?

- The EU will require significant volumes of CRMs to meet its clean energy targets. While there is potential to increase domestic production and recycling, a substantial supply gap is projected. The success of the EU’s CRM strategy will depend on the timely development of new mines and processing facilities, the scaling up of innovative technologies, and securing diversified and responsible sourcing from international partners.